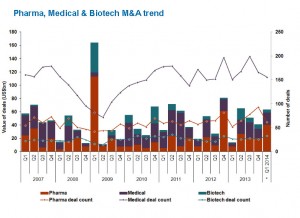

M&A activity in the pharmaceutical and medical industries is up by 428% in deal volume in the first quarter of the year, according to data provider mergermarket. What is driving the current spate of deals? How wise it? The answer to these questions, and other insights on M&A will be topics at “Build, Borrow, Buy”, an evening conference in Geneva coming up on Thursday May 15, 2014.

Pharmaceutical industry M&A is being described variously as a “boom” and “frenzy” in the press. The impact on the involved companyies’ growth and survival rate are topics that INSEAD Professor Laurence Capron is expected to explore in-depth in her presentation at the upcoming event.

She will also moderate a panel of high-profile life science industry executives, venture capital and corporate finance professionals, including Marvelle Sullivan, Head of Global M&A Novartis, Michèle Ollier, LifeSciences, Partner, Index Ventures, Jean-Pierre Rosat, CEO, Aleva NeuroTherapeutics, Alex Schmitz, VP Business Development, Biosensors International, Daniel Kubitza, Executive Director UBS, and Thimo Sommerfeld, Co-Founder and Managing Director, Abolon Group.

This event will also be a great opportunity to welcome the Wharton Alumni Club, Professor Capron having directed the INSEAD-Wharton alliance from 2007-2010. More details and tickets on http://www.amiando.com/BBB2014.html