The best MBA graduates are the target of private equity firms and hedge funds who offer above average compensation packages to seal the deal, according to Poet&Quants. The median base salary for those MBAs who make it in private equity is USD 150,000, which is USD 25,000 more than the median for the entire graduating class. For example, of the 37.9% of Columbia’s Class of 2013 that ventured into finance, 3.2% were “lucky enough to land a PE job”, says the report. Dartmouth’s Tuck School of Business placed 2% of last year’s grads in private equity, where the median starting salary also was $150,000, higher than any other financial category.

The best MBA graduates are the target of private equity firms and hedge funds who offer above average compensation packages to seal the deal, according to Poet&Quants. The median base salary for those MBAs who make it in private equity is USD 150,000, which is USD 25,000 more than the median for the entire graduating class. For example, of the 37.9% of Columbia’s Class of 2013 that ventured into finance, 3.2% were “lucky enough to land a PE job”, says the report. Dartmouth’s Tuck School of Business placed 2% of last year’s grads in private equity, where the median starting salary also was $150,000, higher than any other financial category.

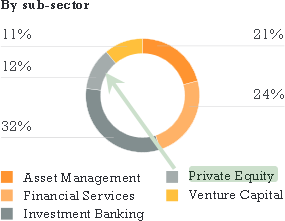

INSEAD’s latest data on grad recruitment trends says that 12% of 2012’s graduates that were recruited into the Finance sector went into private equity. (See graphic).

Poets&Quants analyzed member profiles on LinkedIn to come up with a list of MBAs and top PE firms. The single largest PE employer of MBAs appears to be The Blackstone Group, followed by Bain Capital and The Carlyle Group. The results show that Harvard Business School has the most MBAs employed at the nine PE shops we studied, with 269 grads. Wharton comes next with 242 grads in place, while Columbia Business School is third with 133 MBAs.

For members interested in private equity, it is worth noting and attending the INSEAD Private Equity Club (IPEC) of Switzerland’s upcoming Evening Conference and Panel Discussion in Zurich on “Investment Opportunities for Swiss Enterprises in Asia“. Register here.